Explore web search results related to this domain and discover relevant information.

Tip Location Device Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

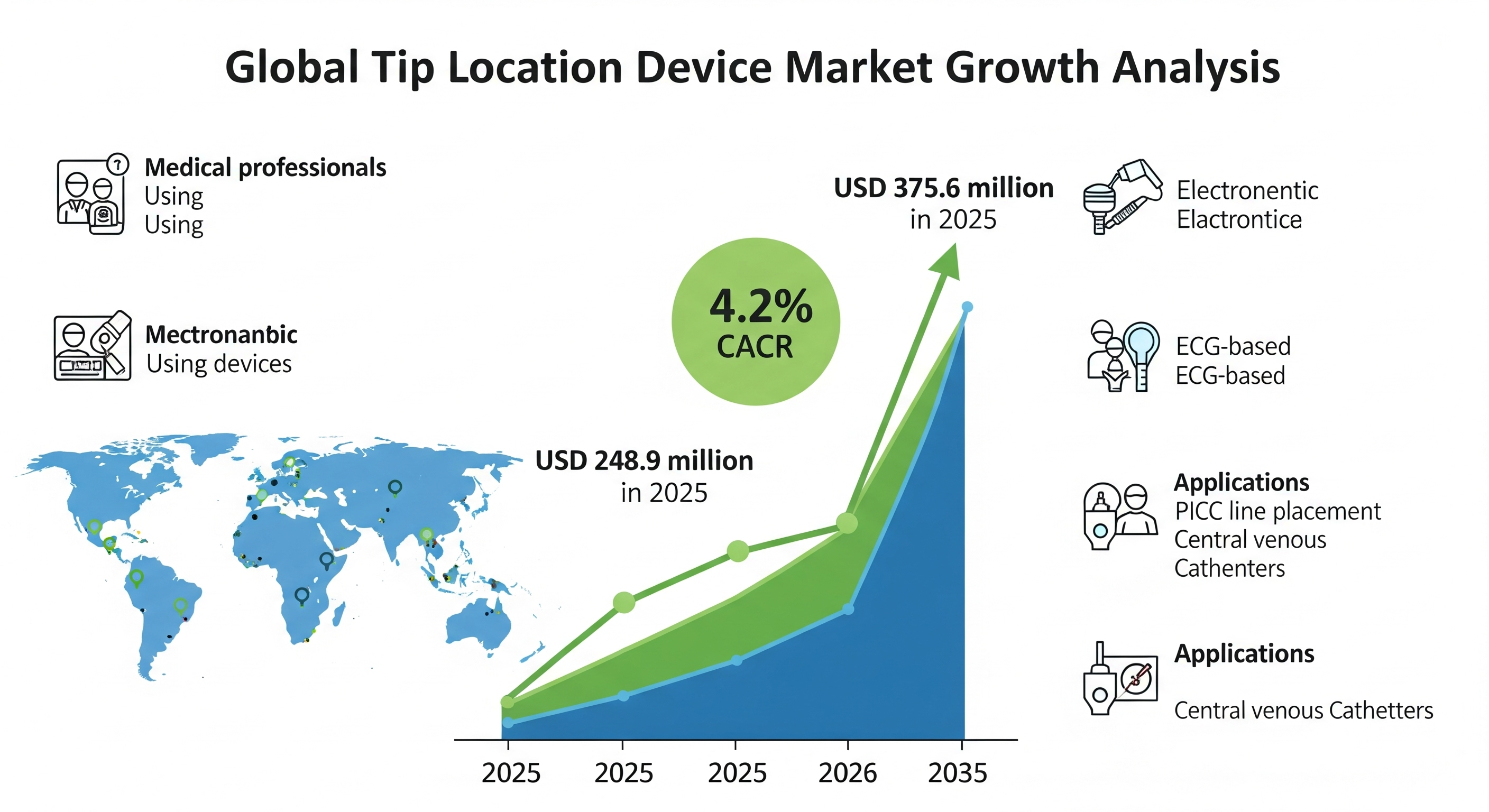

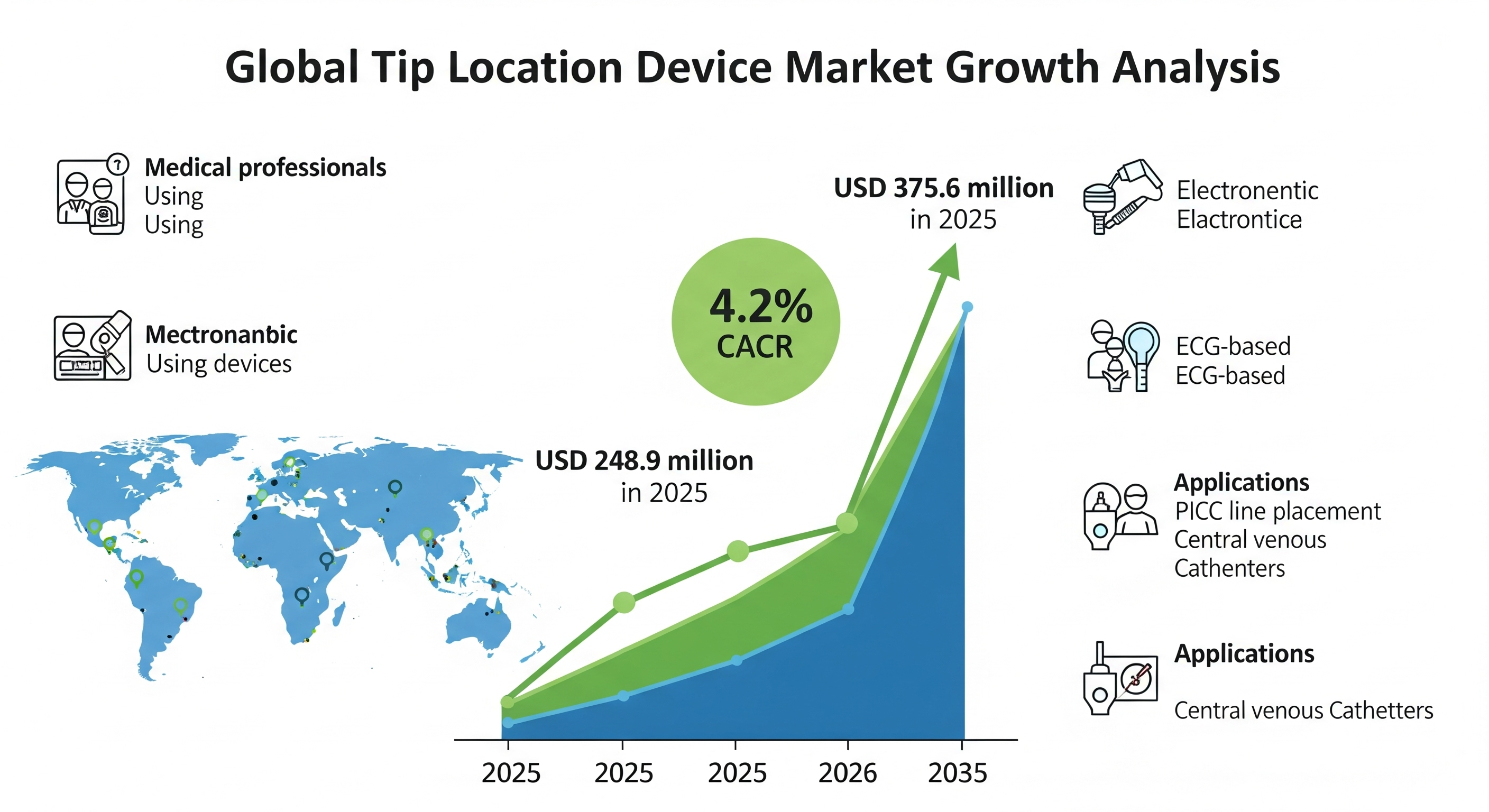

The global Tip Location Device Market is entering a new era of growth, innovation, and accessibility. Valued at USD 248.9 million in 2025, the market is projected to expand steadily to USD 375.6 million by 2035, reflecting a CAGR of 4.2% over the forecast period.Mid-term projections indicate the market will approach USD 305.7 million by 2030, underscoring consistent clinical reliance on these devices. This steady expansion is driven by increasing demand for accurate catheter placement, advances in real-time imaging and monitoring technologies, and growing awareness of patient safety protocols worldwide. As hospitals and healthcare systems seek reliable and efficient vascular access solutions, tip location devices are proving indispensable for critical care, oncology, dialysis, and interventional procedures.These global leaders are strengthening their product portfolios with next-generation tip location technologies that integrate high-precision ECG confirmation, intuitive user interfaces, disposable options, and enhanced imaging accuracy. By aligning R&D with clinical needs, these companies ensure healthcare professionals have access to smarter, faster, and safer vascular access tools. At the same time, emerging manufacturers and regional players are stepping into the market, particularly in Asia-Pacific and Europe.Germany (2.9% CAGR) and the United States (2.7% CAGR) reflect more mature markets where adoption continues incrementally, supported by advanced R&D and reimbursement frameworks. These diverse growth rates highlight how both emerging economies and mature healthcare systems are creating unique opportunities for global and regional players alike. ... The future of the tip location device market is being shaped by continuous innovation.

Stoke-on-Trent named tipping capital of Britain with residents leaving an average gratuity of £10.54 · Can YOU guess which of these celebrity videos are AI deepfakes designed to steal your cash? Fewer than 4% of people get them all right · Kraft Heinz splits as troubled firms bid to revive fortunes a decade on from merger orchestrated by Warren Buffett · Bond market ...

Stoke-on-Trent named tipping capital of Britain with residents leaving an average gratuity of £10.54 · Can YOU guess which of these celebrity videos are AI deepfakes designed to steal your cash? Fewer than 4% of people get them all right · Kraft Heinz splits as troubled firms bid to revive fortunes a decade on from merger orchestrated by Warren Buffett · Bond market jitters send gold price to record high as investors seek safe havensSumUp said the reason for such large jumps in these cities may be because fewer merchants there were using the tip option on card readers in 2022, compared with 2025. Corin Camenisch, product marketing lead at SumUp: ‘This data shows just how much tipping patterns have fluctuated across the UK since 2022.This is Money has analysed tipping data from payments service provider SumUp across thousands of pubs, restaurants, cafes, shops and other retailers.You can choose on each post whether you would like it to be posted to Facebook. Your details from Facebook will be used to provide you with tailored content, marketing and ads in line with our Privacy Policy.

The Cardano price prediction narrative grows as the token attempts a breakout toward $1. Despite optimism from the bulls, ADA whales are buying Remittix (RTX), a PayFi project tipped as one of the most disruptive forces in the crypto market for 2025.

Home » News » Cardano Price Prediction: ADA Whales Have Started Buying $RTX As Analysts Tip PayFi As The Next Big MarketThe technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.

Conclusion: When an I Bond has ... a 5-year TIPS with a real yield of 1.10%. I call I Bonds a “relic” investment because they have arcane rules for rate-setting that allow yields to stay steady for a full six months after any purchase. In addition, since yields are tied to inflation, I Bonds aren’t directly linked to market interest rate ...

Conclusion: When an I Bond has a fixed rate of 1.10%, it is a superior investment to a 5-year TIPS with a real yield of 1.10%. I call I Bonds a “relic” investment because they have arcane rules for rate-setting that allow yields to stay steady for a full six months after any purchase. In addition, since yields are tied to inflation, I Bonds aren’t directly linked to market interest rate trends.That’s a bit iffy because the Federal Reserve is likely to cut short-term interest rates on September 17, and the 5-year TIPS real yield tends to move with those decisions. At this point, however, I think the rate cut is priced in. In this chart, I added 44 days at current market real yields, which lowers the 5-year real yield average to 1.420% and in turn drops the 0.65 ratio to 0.923%, resulting in a new fixed rate of 0.90%. The forecast using the 10-year real yield remains at 1.30%, but I don’t believe it is relevant.A rather ominous AI image for “Bond investors locked out of market.” Source: Google Gemini ... A few years ago, I was writing about bid-ask spreads for TIPS on the secondary market and noted I was able to purchase a “very small” order of $10,000 with a bid-ask spread only 2 basis points below a high-dollar purchase..This TIPS will mature February 15, 2055. It has a coupon rate of 2.375%, which was set by the originating auction on February 20, 2025. Demand at this auction looked strong. The “when-issued” yield prediction was 2.673%, but bidders brought that down to 2.650%. The bid-to-cover ratio was 2.78, much higher than recent auctions of this term. There is a market for 30-year TIPS!

Looking ahead, policy proposals like tax exemptions on tips—floated in political circles—could offer relief, but experts warn they won’t address root causes like wage stagnation. As one X post from a market analyst noted in August 2025, with tips at 14.99% across sectors, the service ...

Looking ahead, policy proposals like tax exemptions on tips—floated in political circles—could offer relief, but experts warn they won’t address root causes like wage stagnation. As one X post from a market analyst noted in August 2025, with tips at 14.99% across sectors, the service industry must innovate, perhaps through better training or incentives like freebies to boost gratuities, as suggested in a Business Insider piece.For now, the decline signals a pivotal moment: will tipping endure, or will restaurants pivot to fairer pay structures? The answer could define the next era of American hospitality. ... News & updates for website marketing and advertising professionals.Tipping in U.S. restaurants has dropped to a record low of 19.1% in Q2 2025, driven by tip fatigue, inflation, and rising costs. This slump hurts workers reliant on gratuities, exacerbating staffing shortages. Restaurants may shift to no-tip models or fairer wages to adapt.Deliver your marketing message directly to decision makers.

Overall Morningstar Rating for iShares TIPS Bond ETF, as of Aug 31, 2025 rated against 141 Inflation-Protected Bond Funds based on risk adjusted total return. Morningstar has awarded the Fund a Bronze medal. (Effective Nov 01, 2024) ... Holdings are subject to change. The values shown for “market ...

Overall Morningstar Rating for iShares TIPS Bond ETF, as of Aug 31, 2025 rated against 141 Inflation-Protected Bond Funds based on risk adjusted total return. Morningstar has awarded the Fund a Bronze medal. (Effective Nov 01, 2024) ... Holdings are subject to change. The values shown for “market value,” “weight,” and “notional value” (the “calculated values”) are based off of a price provided by a third-party pricing vendor for the portfolio holding and do not reflect the impact of systematic fair valuation (“the vendor price”).The iShares TIPS Bond ETF seeks to track the investment results of an index composed of inflation-protected U.S. Treasury bonds.For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs.Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Any applicable brokerage commissions will reduce returns. Beginning August 10, 2020, market price returns for BlackRock and iShares ETFs are calculated using the closing price and account for distributions from the fund.

As of 11:44:40 AM EDT. Market Open. ... Avg. Volume ... The index tracks the performance of inflation-protected public obligations of the U.S. Treasury, commonly known as “TIPS,” that have a remaining maturity of more than one year. The fund will invest at least 80% of its assets in the ...

As of 11:44:40 AM EDT. Market Open. ... Avg. Volume ... The index tracks the performance of inflation-protected public obligations of the U.S. Treasury, commonly known as “TIPS,” that have a remaining maturity of more than one year. The fund will invest at least 80% of its assets in the component securities of the index, and it will invest at least 90% of its assets in U.S.Find the latest iShares TIPS Bond ETF (TIP) stock quote, history, news and other vital information to help you with your stock trading and investing.PXF Invesco RAFI Developed Markets ex-U.S.U.S. markets close in 4h 15m

The S&P U.S. Treasury Inflation Protected Security Index seeks to measure the performance of the U.S. TIPS Market.

S&P U.S. TIPS 30 Year IndexS&P U.S. TIPS 0-1 Year IndexS&P U.S. TIPS 0-10 Year IndexS&P U.S. TIPS 0-15 Year Index

We sell TIPS for a term of 5, 10, or 30 years.

You can use our page on the daily index ratios to see how your TIPS principal is changing. Buy a Treasury marketable security · Find out about tax forms and tax withholding · Get my money when my security matures (redeem the security) Reinvest my money in the same type of security ·As the name implies, TIPS are set up to protect you against inflation.Unlike other Treasury securities, where the principal is fixed, the principal of a TIPS can go up or down over its term.When the TIPS matures, if the principal is higher than the original amount, you get the increased amount.

He is a Chartered Market Technician (CMT). ... United States Treasury inflation-protected securities (TIPS) are a simple and effective way to eliminate one of the most significant risks to fixed-income investments—inflation risk—while providing a real rate of return guaranteed by the U.S.

However, if the goal is to receive a fully diversified fixed-income portfolio of TIPS, a mutual fund is the best option, preferably a low-cost index fund. In the context of portfolio asset allocation, fixed income plays a vital role for investors of all sizes. Keep in mind that over long time periods, fixed income provides much lower returns than equities, but it also provides much lower levels of return volatility. As such, fixed income serves to reduce overall portfolio volatility, especially during times of market stress when equities may fall substantially.As is the case with any other investment vehicle, TIPS can be used tactically. Just as one may purchase equities at a low price or nominal bonds in anticipation of a decrease in interest rates, TIPS can be used to market time according to an investor's expectations for inflation.Using the example above, if an investor believes inflation will actually move upward to 3.5%, that investor would buy a TIPS because it will become more valuable if actual inflation is greater than what the market expected.Conversely, if an investor believes inflation will be lower than 2.5%, or that deflation will occur, the investor will either sell their existing TIPS or wait for a devaluation to occur before buying. However, timing inflation expectations is no easier than market timing any other security.

Analyze anywhere. Anytime.Discover a new stock market research experience with TipRanks app

TipRanks stock market research and analysis, lets you see the track record and measured performance of any analyst or blogger, so you know who to trust!

We investigate the influence of public companies on their local economies through the spending of their employees on local goods and services. Using t…

In addition, tipping increases gradually following the initial public offerings (IPOs) of firms, and this increase becomes significant at the end of the IPO lock-up period. Idiosyncratic stock returns are more strongly associated with tipping than are aggregate stock market or industry returns, suggesting that the increase in tipping with stock returns is due to firm-level factors.For instance, this was a primary reason why Arlington County, Virginia, recently offered Amazon.com, Inc., tax and other incentives to become the location of its new headquarters.1 However, little is known about how this newly created demand for local goods and services varies with the firm’s stock market performance. The primary proxy for spending in our study is the tip paid to taxi drivers, as the literature shows that tipping is positively correlated with consumer wealth and happiness (e.g., Lynn and Thomas-Haysbert, 2003, Azar, 2005, Saayman and Saayman, 2015, Saayman, 2016), which in our setting are expected to vary by stock returns.If this is the case, the increase in tipping with positive stock price shocks would be more pronounced among the taxi rides taken near firms that offer greater stock-based compensation as the wealth and happiness of these firms’ employees would be more sensitive to the stock market performances of their firms.However, there is heterogeneity in the tipping increase across industries, suggesting that stock returns of industries may contribute to the tipping increase. Nevertheless, we find in additional tests that an increase in firm-specific (idiosyncratic)—rather than industry or stock market—returns is associated with a significant increase in tipping.

Money Market vs. Short-Term Bonds ... Zero-coupon Bond vs. a Regular Bond ... Treasury Inflation-Protected Securities (TIPS) are a type of Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

The interest payments during the life of the bond are subject to being calculated based on a lower principal amount in the event of deflation, but the investor is never at risk of losing the original principal if held to maturity. If investors sell TIPS before maturity in the secondary market, they might receive less than the initial principal.Diversification: Including TIPS in an investment portfolio can enhance portfolio diversification. Though the correlation between investments is always shifting, TIPS can perform differently from other asset classes that may act negatively towards rising prices and inflation. · Market Liquidity: Last, TIPS are highly liquid securities.They can be bought and sold with relative ease in the secondary market. This liquidity means that you don’t have to worry as much about getting stuck with your investment if you do need to sell and sell relatively quickly. Along with those advantages, there are some disadvantages to consider. Lower Yield Compared to Other Bonds: TIPS typically offer lower yields compared to other types of bonds.If the CPI decreases, the principal value of TIPS is adjusted downward. This reduces the overall return on the investment as the overall value of the security decreases. Liquidity Issues in Times of Crisis: We mentioned that liquidity was an advantage. However, during financial crises or periods of market stress, the liquidity of TIPS can be less than ideal.

:max_bytes(150000):strip_icc()/terms_t_tips_FINAL-211fcb82687c47ff918015e788914cff.jpg)

Tip Location Devices Market Insights, Competitive Landscape, and Forecast Report 2024-2032 | BD and Teleflex Advance ECG-based and Ultrasound Systems, with North America Leading the Market

Dublin, Aug. 08, 2025 (GLOBE NEWSWIRE) -- The "Tip Location Devices - Market Insights, Competitive Landscape, and Market Forecast - 2032" has been added to ResearchAndMarkets.com's offering.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content. XRP might be gaining momentum, but another breakout contender is quietly stealing the spotlight.

Its fast-growing GameFi platform – backed by on-chain transparency and deflationary tokenomics – is gaining traction. As Ripple struggles with resistance, many market strategists now view Rollblock as the token with stronger momentum heading into 2025.Rollblock’s crypto presale has drawn over 50,000 early backers and raised $11.6 million across ten rounds. This shows strong belief in both GameFi’s rise and Rollblock’s position in the market.

Among the industries included in the report, restaurant and cafes were found to generate the most tips with an average of $25.20. This was followed by the beauty and transport sectors. For more information, view the full report here. ... The latest Market Report from the International Coffee ...

Among the industries included in the report, restaurant and cafes were found to generate the most tips with an average of $25.20. This was followed by the beauty and transport sectors. For more information, view the full report here. ... The latest Market Report from the International Coffee Organization (ICO) shows the average price of green coffee grew by almost...research from business finance solutions provider Zeller that reveals the number of people leaving a tip and the amount of the tip itself are on the rise in AustraliaAustralian consumers are becoming more generous, according to research from business finance solutions provider Zeller that reveals the number of people leaving a tip and the amount of the tip itself are on the rise across the country.Using EFTPOS data from more than 85,000 Australian businesses, in 2024 Zeller found the frequency of transactions including a tip increased by 13 per cent compared to 2023.

Mid-term projections indicate the market will approach USD 305.7 million by 2030, underscoring consistent clinical reliance on these devices. This steady expansion is driven by increasing demand for accurate catheter placement, advances in real-time imaging and monitoring technologies, and ...

The global Tip Location Device Market is entering a new era of growth, innovation, and accessibility. Valued at USD 248.9 million in 2025, the market is projected to expand steadily to USD 375.6 million by 2035, reflecting a CAGR of 4.2% over the forecast period.Mid-term projections indicate the market will approach USD 305.7 million by 2030, underscoring consistent clinical reliance on these devices. This steady expansion is driven by increasing demand for accurate catheter placement, advances in real-time imaging and monitoring technologies, and growing awareness of patient safety protocols worldwide. As hospitals and healthcare systems seek reliable and efficient vascular access solutions, tip location devices are proving indispensable for critical care, oncology, dialysis, and interventional procedures.These global leaders are strengthening their product portfolios with next-generation tip location technologies that integrate high-precision ECG confirmation, intuitive user interfaces, disposable options, and enhanced imaging accuracy. By aligning R&D with clinical needs, these companies ensure healthcare professionals have access to smarter, faster, and safer vascular access tools. At the same time, emerging manufacturers and regional players are stepping into the market, particularly in Asia-Pacific and Europe.Germany (2.9% CAGR) and the United States (2.7% CAGR) reflect more mature markets where adoption continues incrementally, supported by advanced R&D and reimbursement frameworks. These diverse growth rates highlight how both emerging economies and mature healthcare systems are creating unique opportunities for global and regional players alike. ... The future of the tip location device market is being shaped by continuous innovation.

Moovit helps you to find the best routes to Tip Top Market,Karol Bagh using public transit and gives you step by step directions with updated schedule times for bus, metro or train in Delhi.

DB Gupta Market is 530 meters away, 7 min walk. Kikar Wala Chowk is 543 meters away, 8 min walk. Jhandenwalan is 1225 meters away, 16 min walk. Vivekanand Puri Halt is 1833 meters away, 24 min walk. These bus lines stop near Tip Top Market,Karol Bagh: 181A, 212, 218, 39, 522, 610, 949, 966.Gupta Road; Thana DB Gupta Road; DB Gupta Market; Kikar Wala Chowk; Jhandenwalan; Vivekanand Puri Halt. Bus: 181A, 212, 218, 39, 522, 610, 949, 966, NCR, 3, 88A, GL-91, 156, 214A, 309, 842.Train: EMU 64031, EMU 64071, EMU 64091, EMU 64011, EMU 64012, EMU 64013, EMU 64014, EMU 64015.Metro: 3, 4. Want to see if there’s another route that gets you there at an earlier time? Moovit helps you find alternative routes or times. Get directions from and directions to Tip Top Market,Karol Bagh easily from the Moovit App or Website.These train lines stop near Tip Top Market,Karol Bagh: EMU 64031, EMU 64071, EMU 64091.These metro lines stop near Tip Top Market,Karol Bagh: 3, 4.

The global PICC tip placement systems market has been steadily growing driven by advancements in technology and increasing demand for precise vascular access methods Persistence Market Research estimates the market size at US 120 6 million in 2022 with a ...

Press release - Persistence Market Research - PICC Tip Placement Systems Market to Reach US$ 210.5 Mn by 2032, Expanding at 5.7% CAGR - published on openPR.comThe market is primarily fueled by the rising demand for efficient central venous catheter placement, which is crucial for patients undergoing long-term intravenous treatments or surgeries. PICC (peripherally inserted central catheters) tip placement systems are critical in ensuring the accurate positioning of catheters, minimizing the risks associated with improper placements, which can lead to significant medical complications.The use of technologies such as ECG (electrocardiogram) tip confirmation and magnetic tracking is transforming the landscape, offering a safer and more reliable alternative to traditional methods like chest X-rays. Currently, these systems account for approximately 2.2% of the global vascular access devices market, highlighting their niche yet growing presence.These systems, which help detect the catheter tip location with high accuracy, account for the largest share of the market due to their ability to minimize errors in catheter placement and reduce reliance on X-rays. On the other hand, ECG tip confirmation systems offer greater precision and cost-effectiveness by eliminating the need for X-rays.

And even though customers are complaining, businesses aren't fighting it because of the third main driver of tip-flation: the job market.

Tipping has gotten out of control: Three reasons behind tip-flation The pandemic, technology and the economy have combined to create the perfect storm for "tip-flation" — but we might be at a tipping point.Tipping is on the rise across the U.S. but customers are getting frustrated and many are reaching a tipping point. Nam Y. Huh/AP hide caption toggle caption Nam Y.It's the moment when you've ordered your coffee and the barista turns the payment screen toward you, with prompts asking you for a tip.Social media is filled with people who are outraged, shocked or just plain confused about tipping.

:max_bytes(150000):strip_icc()/terms_t_tips_FINAL-211fcb82687c47ff918015e788914cff.jpg)